If you live in Canada, you may or may not already be aware that the government does not tax our groceries. However, what you consider groceries and what the government considers groceries might not be the same thing.

Already know about the snack tax? Read on to find out ways to source tax-free chocolate and how to avoid a sneaky nut tax.

If this is news to you, you might want to check out my previous post explaining sales tax and how a little bit of knowledge can save you a whole lot of money.

Snack tax basics

In January 2007, the Canada Revenue Agency published a memorandum (updated from an earlier document) which sets out exactly which foods in Canada get taxed to the fullest extent under the law and which are not taxed at all.

The very first paragraph states:

The supply of basic groceries, which includes most supplies of food and beverages marketed for human consumption (including sweetening agents, seasonings and other ingredients to be mixed with or used in the preparation of such food or beverages), is zero-rated. However, certain categories of foodstuffs, for example, carbonated beverages, candies and confectionery, and snack foods are taxable. If a product’s tax status is in doubt, the CRA will consider the manner in which the product is displayed, labelled, packaged, invoiced and advertised to determine its tax status.

Note: In this publication “taxable” means subject to GST at 5% or HST at 13% and “zero-rated” means subject to GST/HST at 0%.

I have to admit. As far as government documents go, that’s pretty straightforward. If it’s meant to be eaten or drunk by human beings and doesn’t have bubbles or loads of sugar, then it’s a basic necessity and shouldn’t be taxed.

However, it’s not as simple as that. Hence the 167 paragraphs that follow. After all, what one person considers a snack another person may consider a meal. And an indulgence for one is a necessity for another.

Thank goodness we have the government to set us straight, right?

Some guidelines to get you started

Although it doesn’t make for particularly stimulating reading, I do highly recommend you peruse the CRA’s memorandum on groceries. It’s rather enlightening and will make you wonder what it’s like to be one of the people tasked with writing these documents.

At least it made me wonder: I mean, seriously, imagine being the person who had to research and then justify why shark cartilage should be taxed.

But if you want a shortcut, there are some basic (though not foolproof) guidelines for deciding whether you are about to get hit with additional costs at checkout.

Ask yourself the following questions about the item you are about to buy:

- Is it salty? (Not just savoury but actually salty.)

- Is it sweet? (But not naturally sweet, like fruit.)

- Does it have bubbles?

- Is it a single serving and ready to eat?

- Is it marketed as a snack? (Check the labelling and where it is sold in the store.)

If you answered yes to any one of these questions, be prepared to pay sales tax.

Getting around the rules

Now, I’m no libertarian. I think taxes have their place. But knowledge is power, and if you are aware of some of the finer points of sales tax law, you can avoid some unnecessary extra spending on your “snacks.”

Here are a few tips:

Tax-free chocolate

Do we need any further evidence that our government is dominated by men than the fact that chocolate is not considered a basic necessity of life?

However, there is chocolate that is zero-rated. And I’m not just talking about cacao powder, beans and nibs. (I’ve actually taken to snacking on whole cacao beans, and let me tell you they are very tasty.) Since they’re unsweetened baking ingredients, they already fall into the zero-rated category.

But being a baking ingredient is key. It can even save sugar-added goods from the tax man’s jurisdiction.

Remember the distinction over marketing? It means that goods mainly marketed as something other than a snack – such as a baking ingredient – are not subject to sales tax.

Rather than buying your chocolate from the snack aisle, try cruising the baking aisle instead and see what you can find there. Chocolate chips, for example, are a perfectly respectable baking ingredient. And while you may not want to put out a bowl of chocolate chips when you have guests over, they are perfect for your ordinary, everyday cravings.

It may take a little mental leap. It’s not that the chocolate in the baking aisle is any lower quality than the stuff among the cookies and chips (in fact, it may even be higher depending on the brand), but we have been conditioned to target the pretty packaging.

Think about the infamous so-called “pink tax” which causes a product marketed toward women to be priced higher than one marketed toward men, even though they are exactly the same in terms of their ingredients. But it can be hard for a woman to go into the men’s section of a store or just move to a different shelf and buy, say, a “men’s” shaving gel instead of a “women’s,” even though they’d be getting the same product at a lower price.

Think of it this way: the marketers and the government are capitalizing on your psychological weaknesses. Don’t let them. Show them who’s boss.

That’s just nuts

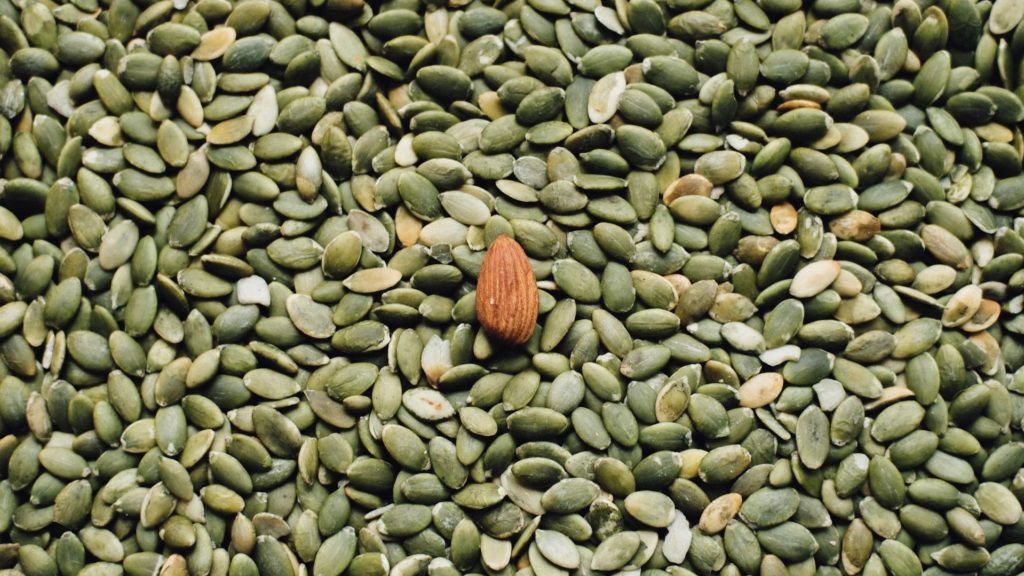

Here’s a conundrum: Are nuts a basic food or a snack? Well, it depends.

If your nuts have any kind of salt on them, they are a snack. If they have some kind of flavouring on them but that flavouring does not include salt, they are a food.

HOWEVER, if your unsalted nuts, which individually are food and so not taxed, are combined together in one package of two or more varieties of nuts, then they are a snack and so taxed.

You think I’m joking? Here’s what the Government of Canada has to say on the subject:

60. Salted nuts or salted seeds (e.g., salted peanuts, sunflower seeds, mixed nuts) are taxable.

61. Nuts or seeds may also be available in various flavours such as Cajun or barbeque. If the seasoning or coating includes salt as an ingredient, the nuts or seeds are taxable.

69. A supply of a mixture of two or more types of nuts, whether salted or not, is taxable. However, mixtures of nuts in their natural state (i.e., not further processed than washed and/or cleaned) are zero-rated. Nuts that have been seasoned, roasted or shelled are not considered to be in their natural state.

So what does that mean on a practical level?

It means that if you want a mix of unsalted nuts to snack on, you’ll probably pay less if you buy each individual type you want and mix them together at home because you won’t be paying an additional 5% or 13% (depending on where you live) on top of the already fairly high price of nuts.

I say probably because it would be hard to do a real price comparison because different nuts have different prices, which then factors into the overall cost of the nut mix. That’s why mixes high in cashews, say, are more expensive, while the cheapest nut mixes are heavy on the peanuts. I suppose I could buy a mix and pick out the individual nuts and weigh them and do a comparison that way…but I’m not that obsessed yet. Yet. If I get there, I’ll let you know.

One final note on nuts: What if you really, really want salted nuts?

My personal opinion? Given the time and effort of salting, or roasting and salting, your nuts at home, you may as well pay the government for the privilege of having them ready-to-eat.

On the other hand, we could all probably reduce our salt intake, so why not learn to like unsalted nuts?

Size matters

One of the important aspects of the snack tax is how an item is marketed. And packaging is a significant factor when determining when something is a snack and when it is not.

The important thing to watch out for here is whether the item you are looking to purchase is a single serving. For example, non-carbonated water and fruit juices would not normally be taxed. But they are when they are sold in servings of less than 600 ml.

But it’s also useful to be aware that some items which would otherwise fall afoul of the snack tax lose their snack status simply by being bought in bulk.

Ice cream is a prime example. Any container of ice cream under 500ml/500g is taxable. But as soon as it exceeds that limit, it is no longer a single serving and becomes zero-rated. Not that I’m necessarily encouraging you to buy more ice cream…

Muffins (and other sweet baked goods) are another good example. Each muffin on its own is taxable. Buy six or more and they’re tax-free.

Choose your own adventure

My final suggestion is a little plug for home cooking.

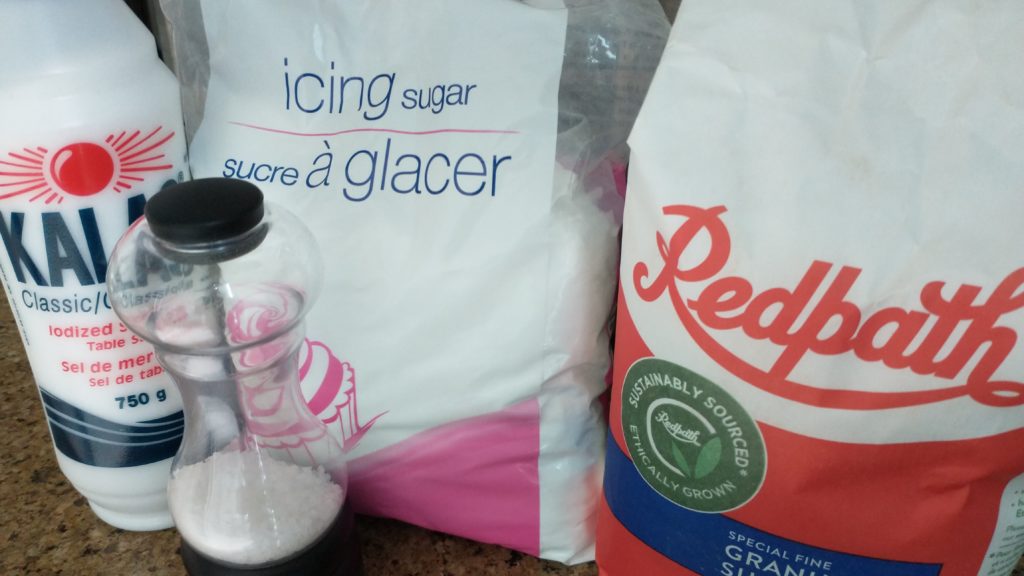

While the packaged snacks take a hefty chunk out of your grocery budget in the form of sales tax, the ingredients they’re made with are zero-rated. Sugar and salt added to a product are a recipe for taxability. But sugar and salt on their own are not taxed.

So why not make your own snacks at home?

Some reasons to make your own snacks:

- You will know exactly what’s going into your food. (Tired of all the preservatives and ingredients you can’t pronounce?)

- You will get exactly what you want. (Want more or less chocolate? More or less spice?)

- Your friends will be impressed.

- You will be impressed with yourself and may find confidence in other areas as well.

- Your snacks will be way, way better than anything you buy in the store.

With all the resources on the Internet these days, you could probably find recipes for anything you can think of. I am so impressed by people’s ingenuity and creativity. Pretty much any snack you buy in the store, I guarantee you someone has posted a recipe for it online. Oreos? Yup. Gummy bears? Absolutely. Pocky? Take your pick.

I wish you luck in whatever adventure you choose!